Australian Normality Index – Week 12

We have now come to the end of our initial 12 weekly program of continuous tracking. This longitudinal study has provided us with a wealth of systematic data and insights on the core dynamic between how we have been feeling, thinking and behaving in response to the COVID-19 crisis. And as professional researchers and marketers we have been continually surprised by the rapidity of change we have observed in metrics that we generally see move very slowly.

The outputs of this body of work have been provided to you in weekly instalments and also in our overview report published last week.

We will now move to a monthly cadence and keep you updated on both the time series established and any new metrics arising from our qualitative work on understanding enduring change in the Australian market place.

This week we have attached the final weekly report (see attached). Additionally, we are currently synthesising this rich quantitative data set with our growing qualitative insights to distil further understanding and learning around the potential and actual changes in Australian’s consumption behaviour. This work includes our rapid ethnography which allows us to take a deep contextualising dive into how our values and behaviours are changing. We anticipate publishing that report to you in early July. As always, our aim is to support our clients with solid evidence of market and customer activity to allow you to shape your strategy for the “new normal”

Analytics

Aus Normality Index – Week 12

Posted 23 Jun 2020

KEY OBSERVATIONS from WEEK 12

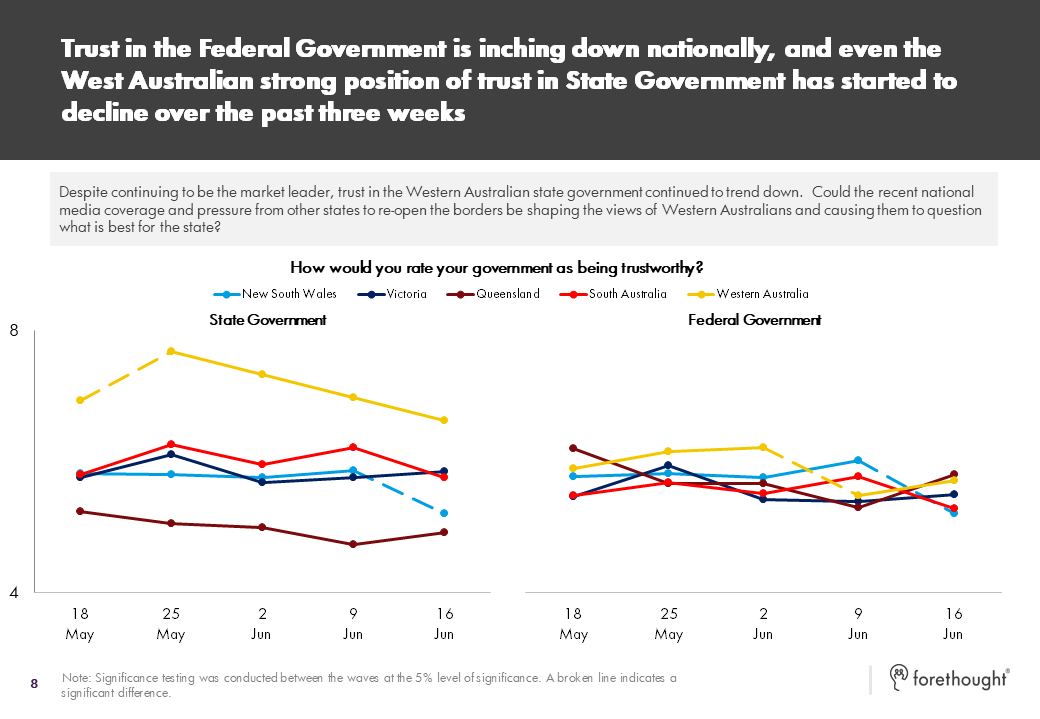

- CONFIDENCE IN THE ECONOMY DROPPED: In Week 9 as all the metrics we were measuring were generally improving we posed the question “Are we in the eye of the storm?”. Our thinking was prompted by concern re the impact of the end of JobKeeper in late September and the likely impact that would have on the economy. Now in Week 12 we are seeing “Confidence in the economy” decline. And it should be noted that this result was recorded prior to this weekend’s news re the resurgence of COVID-19 outbreaks in Victoria. Our sense of normality was being driven by a flattening of the curve and a releasing of restrictions. As new outbreaks emerge we will need to see them well managed by our governments. And concern re the economy is only likely to continue under these conditions. As we have called out in earlier reports the continuing severe economic contraction will increase the consumer focus on prudence and thoughtfulness re purchasing behaviour. Brands need to look to both their actual offer and the communication of value in this new more austere environment.

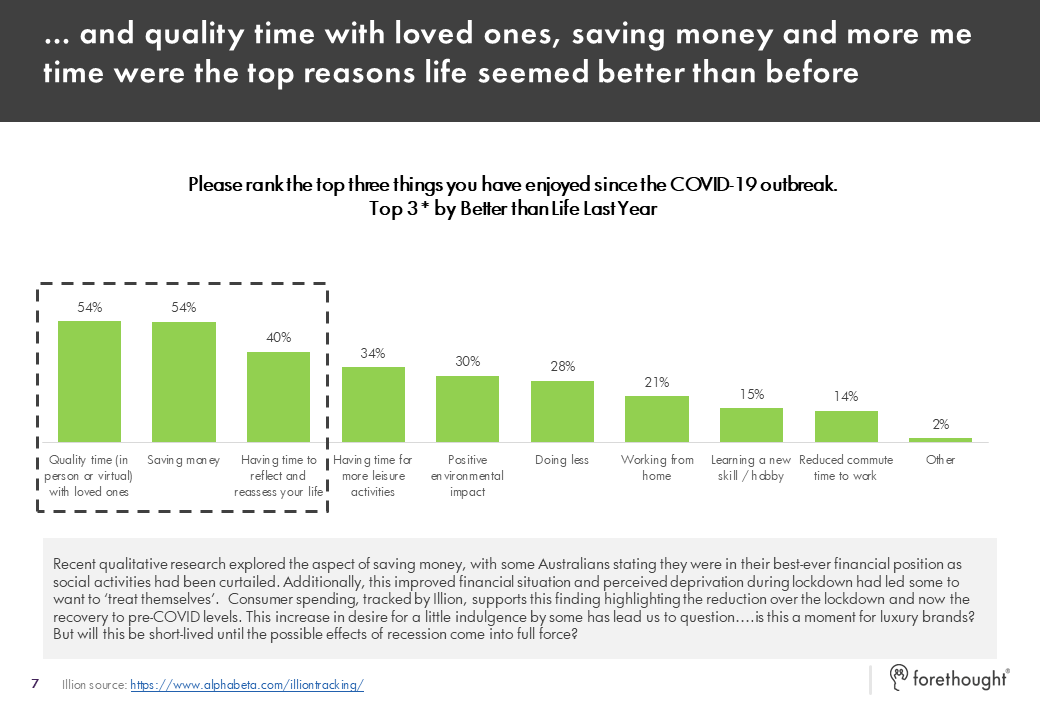

- A SLOWER, HAPPIER LIFE? Some of us are feeling that life is better that it was before lockdown. Lifestyle benefits reported included time with family and friends, saving money and time for reflection. How might brands tap into these changing behaviours and values?

- TIME FOR SMALL INDULGENCES: In our qualitative exploration of the Normality Index findings, we have found that some Australian’s feel they currently have more disposable income than before. This is particularly the case with younger Australians. Their routine spending has been curtailed (going out less, eating at home etc). So now they are considering rewarding themselves with some indulgences – luxury items? New tech toys? For consumer goods brands there would seem to be an opportunity to consider what is your ‘lipstick’ offer. That is, the indulgent purchase that makes us feel better.

Marketing Advisory, Strategy and Analytics

Marketing Advisory, Strategy and Analytics