Return To Normality? A Pulse on USA Consumer Normality Week 5

Baton Change: From health crisis to economic crisis?

Return To Normality? A Pulse on USA Consumer Normality Week 5

Posted 21 Apr 2020

BATON CHANGE:

CONCERNS ABOUT HEALTH MOVE TO ECONOMY

There has been two important changes for Americans this week with:

- A shift in focus from my concerns about my immediate personal and social needs, to being more concerned about the economy; and

- My understanding of long it is going to take to return to normality.

FROM LIVES TO LIVELIHOODS

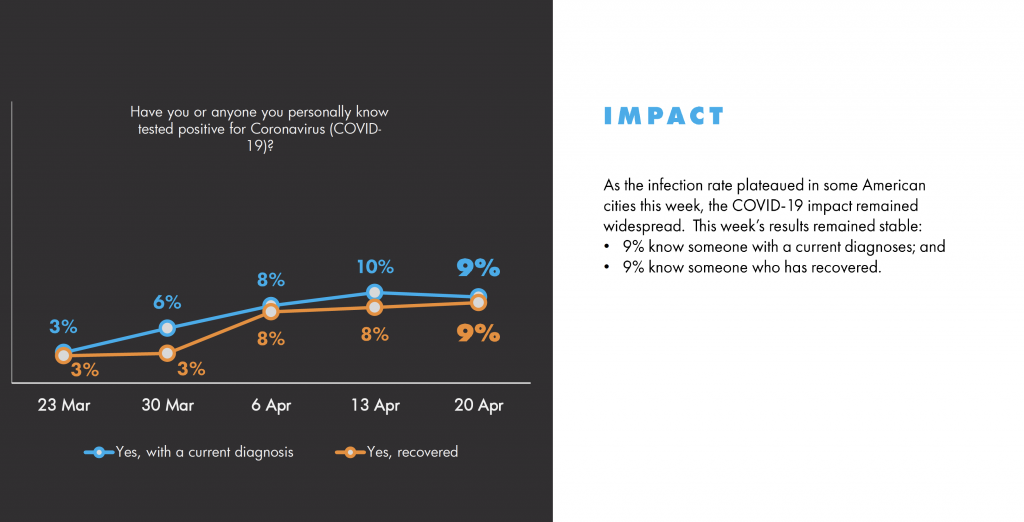

While Americans’ perceptions of their personal lives have slightly improved, concerns have shifted towards economic conditions (despite the stimulus packages), with confidence falling by 8% over the week. Are Americans now finding the unfolding economic crisis more troubling than the health crisis?

OH MY! THIS IS GOING TO TAKE LONGER THAN I FIRST THOUGHT

Last week 45% of Americans thought it would take 6-months or longer before they saw a return to normal. This week that number has grown to 56%. Within those groups the number of people who believe that things will never be normal again grew by 25%.

THERE IS A GREEN SHOOT OF NORMALITY:

THE EARLY ADAPTERS

Forethought has identified a cohort of Americans who are optimistic and appear ready to have their lives set back on the pathway to normal.

Forethought is calling this group the “Early Adapters” (8% of pop). They are young (25-34yo), they are predominantly in full-time work (52%), and their Normality score is a high 75%, compared to the rest of the population at 46%. Brands who can frame offers and communications to engage with this cohort will be targeting the audience who may be the first-responders on pulling the economy through.

Week 5

Fielded 17 – 19 Apr 2020

Study details:

US National Representative Sample

20 Apr (Week 5), n=800

Total sample to date, n= 4,000

THE NORMALITY INDEX

(ALL AMERICANS)

Overall, Americans’ perceptions of normality appear to have stabilized relatively rapidly given the magnitude of events we are all dealing with, at 46% for the second consecutive week.

Are we observing the bottom of their concerns? Is this a sign of adaptation?

PREDICTORS OF RETURNING TO NORMALITY

This model explains the relative importance of everyday aspects of life driving a return to normality. Feeling confident in the economy and feeling comfortable to be out in public are the top drivers predicting a return to normality – improvements in these aspects will signal the green shoots that ‘normal’ is re-emerging.

American consumers will not feel normal until:

- They feel confident in the economy

- They feel comfortable to be out in public

- They are able to attend school/college/work as usual

- They are able to socialize with friends and family

Week 6 results available Monday April 28, 2020

US NATIONAL REPRESENTATIVE SAMPLE, N=800

Access the Nomality Index data below

Marketing Advisory, Strategy and Analytics

Marketing Advisory, Strategy and Analytics