RETURN TO NORMALITY? A Pulse on AUS Consumer Normality - Week 3

Aus Normality Index – Week 3

Posted 15 Apr 2020

AUSTRALIAN NORMALITY INDEX Week 3

75% of Australian’s cant see life returning to normal for at least 6 months, and within that group there has been a 36% increase in the number of people who don’t believe life will ever return to a pre-coronavirus normality. For this 15% of Australian’s they believe there will be a new, as yet unimagined, normal. In Week 3 of the Australian’ Normality Index, we are seeing a 27% increase in online grocery shopping – will this be a part of the new normal? We are seeing a 42% increase in food delivery services – will this be a part of the new normal? And if this online and home delivered mode of shopping is impacting food now, what does that mean for adjacent industries and for general customer experience expectations across all goods and services? The implications for brand and customer experience managers continues to be reshaped as we continue to adjust and adapt to living through the pandemic. Please read on for more information.

Week 3 Fielded 10th – 13th April 2020

Forethought thanks our partner, PureProfile for their support in conducting this weekly research

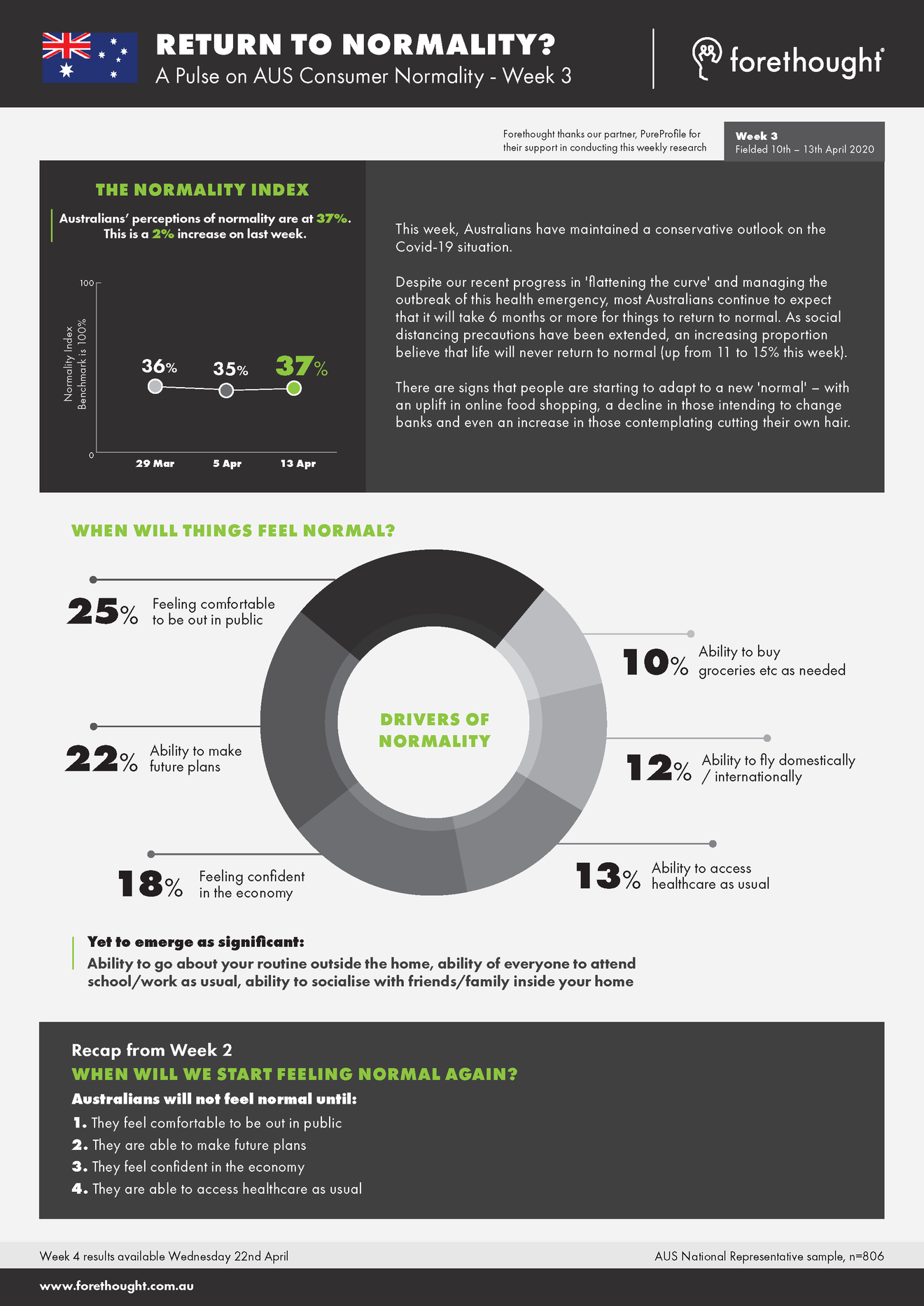

This week, Australians have maintained a conservative outlook on the Covid-19 situation.

Despite our recent progress in ‘flattening the curve’ and managing the outbreak of this health emergency, most Australians continue to expect that it will take 6 months or more for things to return to normal. As social distancing precautions have been extended, an increasing proportion believe that life will never return to normal (up from 11 to 15% this week).

There are signs that people are starting to adapt to a new ‘normal’ – with an uplift in online food shopping, a decline in those intending to change banks and even an increase in those contemplating cutting their own hair.

Keep reading to learn more about the results of Week 3 of the Australian Normality Index.

WHEN WILL THINGS FEEL NORMAL?

Yet to emerge as significant:

Ability to go about your routine outside the home, ability of everyone to attend school/work as usual, ability to socialise with friends/family inside your home

Recap from Week 1

WHEN WILL WE START FEELING NORMAL AGAIN?

Australians will not feel normal until:

- They feel comfortable to be out in public

- They are able to make future plans

- They feel confident in the economy

- They are able to access healthcare as usual

WHAT’S NORMAL? Index numbers across indicators of normality.

Index numbers across indicators of normality.

Thinking about life at present (including wider society), how normal do you feel the following aspects are?

We know for the most part that Australians are banding together and complying with Federal and State Government instructions in terms of staying home where possible. As this graph shows, we are absolutely feeling the impact of being unable to be out and about in public (32%) and our ability to be able to make plans (37%), as these are the most important drivers of our sense of normality. But if we look beyond this data, these vital behaviour changes are being rewarded by a swift reduction in infection rates.

This exhibit tells the story of what will make us feel normal again, and we can see that we are inching up in our confidence to be able to access healthcare and food/grocery supplies (both have statistically significantly improved compared to Week 1). In the weeks preceding the Stage 3 restrictions, and the launch of this study, we saw extraordinary consumer behaviours which led to stock-outs of essential goods, and panic-led visits to medical clinics. Below, we see a steady improvement in how we perceive these two aspects – are these our first indicators of a return to normality?

*Note: This Week 3 result was significantly higher than the Week 1 result.

HOW WILL OUR BEHAVIOUR CHANGE IN THE NEXT WEEK?

There are signs that people are starting to adapt their behaviour to a ‘new normal’.

In the next week, how likely are you to… (On a scale of 0 to 10, only highly likely 8-10 responses shown)

In Weeks 1 and 2, we were processing the shock of ceasing our daily commute, working from home, and home schooling. There was also an initial rush to review our finances. In Week 3, with acclimatisation to our changed situation, some of the financial concerns appear to be eased.

Australians are increasingly adapting to having services arrive at our doorstep, with an uplift in online grocery shopping and food delivery services. Will this become a part of a new normal?

Australians are ‘making do’ and finding solutions to the limitations of our new (temporary) confined living. Two-thirds of us have not yet run out of streaming content and, perhaps ambitiously, one in four of us are considering cutting our own hair.

WHEN WILL WE START TO FEEL NORMAL AGAIN?

Three-quarters of Australians are bracing for a marathon journey, with no return to normality in the immediate future – with a view that it will take at least 6 months. Is this group the Pragmatists or the Pessimists? Within this cohort, there is a growing number of us who cannot imagine a return to the ‘normal’ with 15% of Australians anticipating that a new world will take the place of the old one, that is as of yet probably unimaginable.

*NOTE: THIS WEEK 3 RESULT WAS SIGNIFICANTLY HIGHER THAN THE WEEK 2 RESULT.

Respondents fell into two clusters – those who appear to be the Optimists, who expected life would return to normal within five months. And a more pragmatic or pessimistic group, who believed it would take an extended period of time.

Week 4 results available Wednesday 22nd April

AUS NATIONAL REPRESENTATIVE SAMPLE, N=809

Access the Nomality Index data below

Marketing Advisory, Strategy and Analytics

Marketing Advisory, Strategy and Analytics